Real Estate Reflections: Don't tell the Fed but the Austin market is recovering

Sshhhhh! Don’t tell the Fed, but Austin’s real estate market is recovering.

The Federal Reserve’s efforts to tamp down inflation have made for a bumpy ride in the Austin real estate world this year, but the numbers tell us that the Austin real estate market is recovering. We’ve still got a way to go, but if you’ve been watching for that inflection point that says the market is turning, I think this is it.

Here are 4 reasons I think the Austin real estate market has hit bottom and is on the rise.

FOUR INDICATORS THE AUSTIN REAL ESTATE MARKET HAS HIT BOTTOM

1. Home prices are climbing again

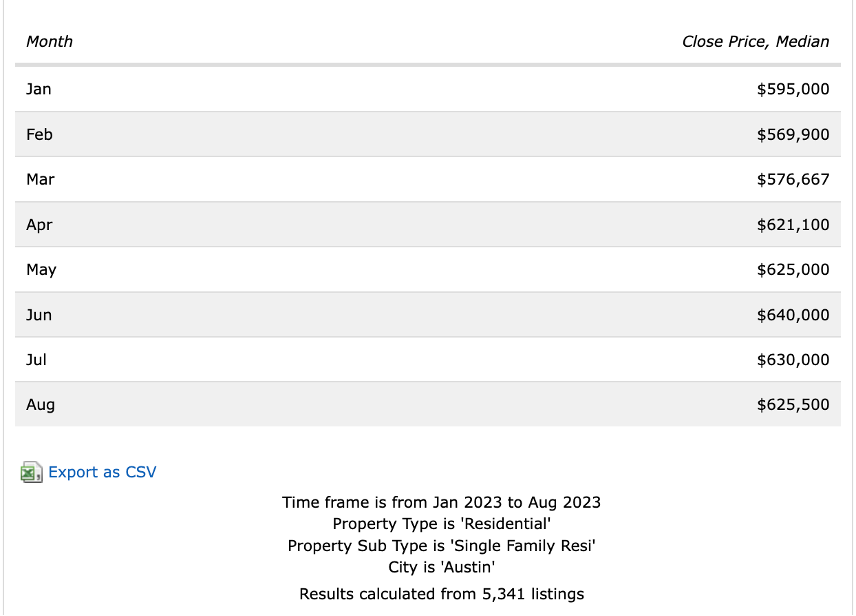

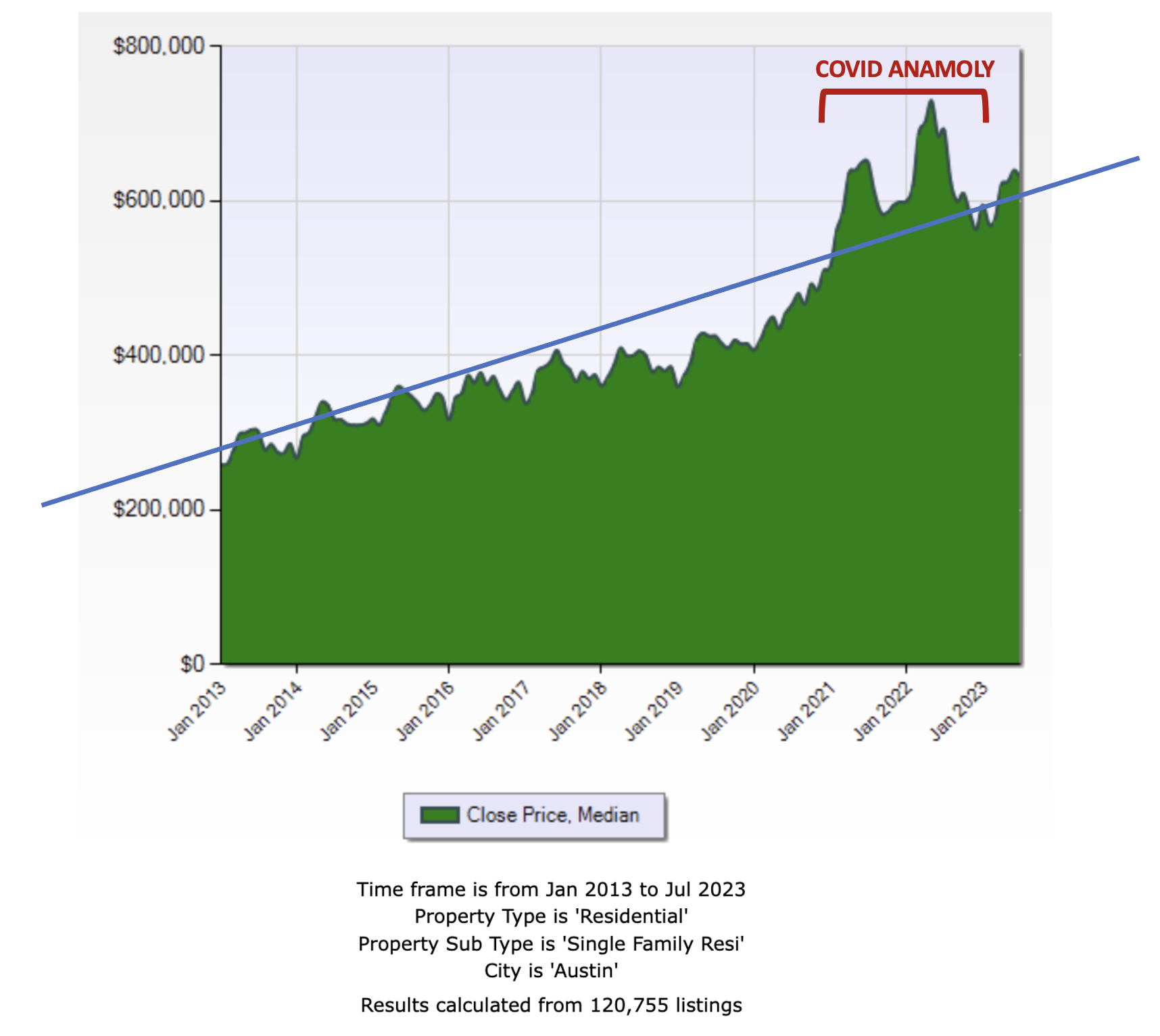

The price of single-family homes in the city of Austin is up 5.13 % from the beginning of 2023. As noted in our January 2023 blog post, prices took a significant dive at the start of the year, effectively wiping out some of the crazy pandemic price appreciation we saw. As you can see in the chart below, Austin home prices are on the upswing. This quick recovery validates the position I laid out in January: Austin was and still is underpriced.

Looking back at the last ten years, you can see that we are closer to where we should be. It’s almost as if COVID never happened to our real estate market.

2. Homes in good condition and priced well are moving quickly

Within the last 30 days, 12 percent of Austin homes were sold within the first seven days of being on the market. If you like to count roofs, a total of 3,339 homes were sold, and 400 of those homes sold their first week on the market.

This tells us that homes with the right stuff (price, condition, location) are able to move fast. This is a big distinction from the 2008 recession when it was just crickets no matter what sellers did. This also tells us there is no risk of under-pricing your home (buyers will see it as a good deal and compete for it), but there is a very real risk of over-pricing your home.

Another measure is average days on market. This metric also shows signs of recovery. Austin’s median days on the market have fallen from 58 days to 25 days. We personally saw a lot of families pushing to close on homes before mid-August so they could get children settled into school, so we will see if this holds now that school has started.

3. Good homes are selling for over the asking amount again

Sticking with our recent home sales, of the 400 homes that sold, 72 of them closed over their original list price. One home even sold for 78% more than the listing price, but it was a real outlier. The median range looks more like 6 - 8% above the asking price.

4. Sellers are giving up less to get their home sold

At the beginning of 2023, Austin home sellers were giving up a median of 3% to make deals work and get their homes sold. This has dropped to 2% as of this writing. It’s still a buyer’s market but things are headed in the sellers’ direction.

WHERE DOES THAT LEAVE AUSTIN HOME BUYERS AND SELLERS?

We aren’t saying the bumpy ride is over. Every year is a little different, so we don’t know what to expect for certain. Interest rates will definitely be a driving factor in how things shape up. Austin has a strong labor market and low unemployment. If other cities across the nation are doing as well as ours, the Federal Reserve could continue to apply pressure and drive rates up further. Interest rates are currently over 7%, so we may see rates at 8% before we see 5% again. That said, I think the worst of our real estate slump is behind us.

Here’s what that means if you are thinking of buying or selling a home in Austin.

IF YOU'RE A BUYER: Austin typically has a seasonal Fall 6-8% decline in home prices with the prices hitting bottom around Halloween. Once we get past Halloween prices tend to slowly climb and then take off again in the early Spring. If Austin’s seasonality holds true and the market is already recovering, this Fall may be the last significant price compression we see before the Austin market accelerates again in 2024. If you can qualify and find a good property that meets your needs, you will be well rewarded in the coming years. Yes, there is some risk here, but it seems like the risk lessons a little every day.

Also, if you are searching for homes in the $1M+ price range, make sure you take a look at off-market properties. Right now, there are 674 properties that are only on the Austin Compass platform, and there many more on the three main private market sites. Check out our August blog post for the skinny on off market listings in Austin.

IF YOU'RE A SELLER: As things sit right now, your home and the price you list it for need to be better than just fair; it needs to be compelling. The risk of overpricing is far greater than underpricing. Ensure your home is fully prepared, staged, and priced below the comparable sales. If you price it too low, the market will correct that for you, but you need to make sure you leave your home on the market long enough to attract multiple offers.

WE'VE RIDDEN THIS ROLLER COASTER BEFORE

Whether this is your 1st real estate deal or your 20th, we’re here to offer honest, expert feedback, and help make it your best deal yet. Please reach out with any questions or if you know someone who could use trusted real estate advice.

.jpg?w=128&h=128)

You might also like

You might also like