Real Estate Reflections: Is cash still king in the Austin real estate market?

Recently we had several buyers purchasing their new home using all cash, and they firmly believed that their all-cash offer would be more compelling than any other offers the seller might receive. Were they right? Is cash still king when buying a home in Austin?

In some cases, but not as much as you might think.

WHAT'S APPEALING ABOUT A CASH OFFER?

Certainly, there are benefits to making a cash offer, not the least of which is that you get to skip the process of securing a loan. Cash offers also make it possible to close quickly – many times in just two weeks – rather than waiting the more traditional 30+ days for the financing to be completed. You also get the benefit of not making interest payments, but you’ll still need to have money to pay for your taxes and insurance.

However, those are not the reasons that most buyers want to make a cash offer. Usually it’s because they believe they can leverage their cash to get a better deal on their purchase.

DO CASH OFFERS MAKE A DIFFERENCE?

The impact of a cash offer heavily depends on the seller’s priorities. There’s no question that cash offers still hold sway in the Austin real estate market, especially when a seller wants a quick closing and greater certainty. Yet, the statistics tell us that cash offers aren’t the “deal maker” we often make them out to be.

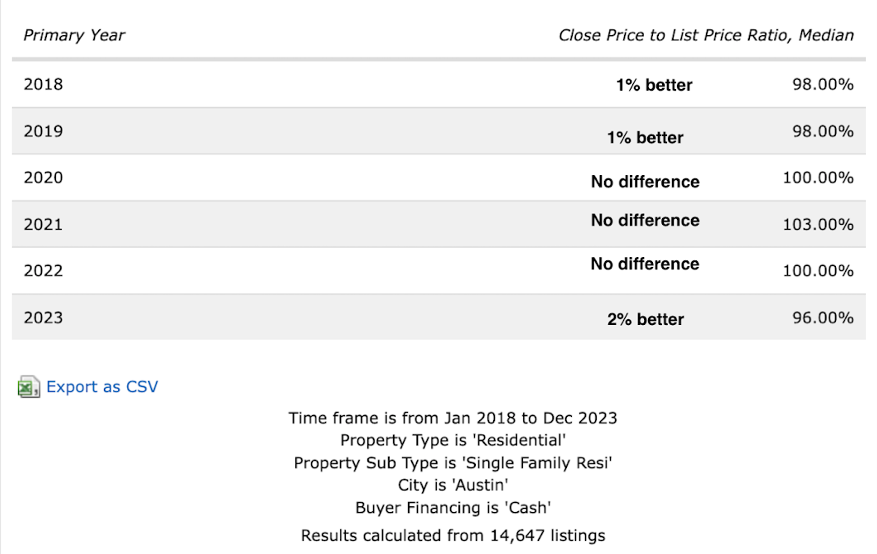

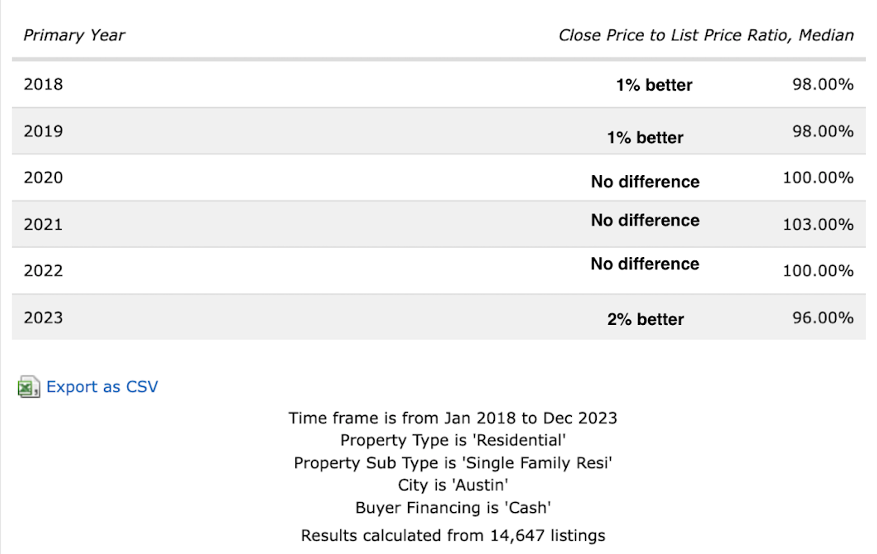

One measure of the power of cash offers is the list to sales price ratio for homes purchased with cash versus those transactions that were financed. If we look at the last five years of public sales of single-family homes in the city of Austin, Texas, there was only one year (2023) where cash buyers got a better deal than financed buyers, and in that year the difference between the list price and sales prices was 2% greater for cash buyers. However, it is possible that 2023 was merely an outlier driven more by higher interest rates and less by the power of the cash offer itself.

For those of you that like charts and data, you can see my sources below.

WHAT PERCENTAGE OF THE AUSTIN REAL ESTATE MARKET IS BOUGHT WITH CASH?

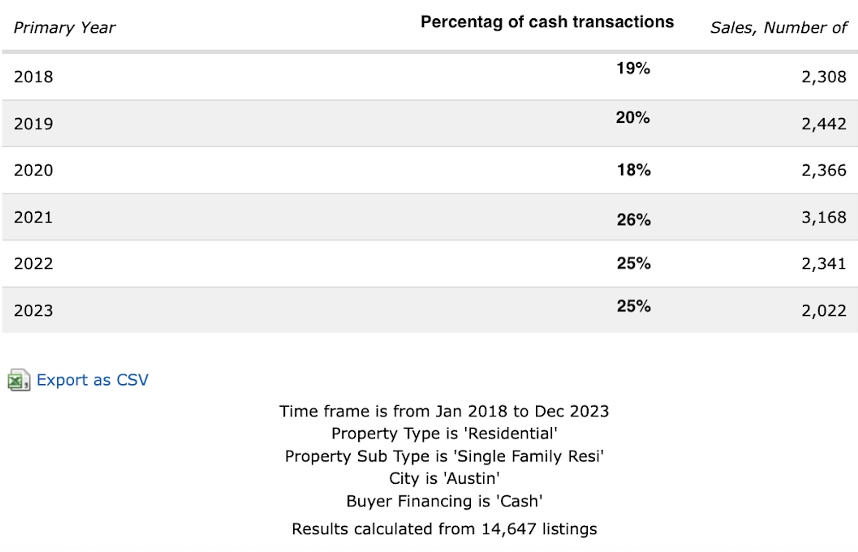

To give those stats more context, we also need to analyze the number of cash offers being made. I initially wondered if there just weren’t that many cash offers out there. Not so….

It turns out that cash transactions in Austin have slowly become more common since 2018:

- 2018: 19% cash buyers

- 2019: 20% cash buyers

- 2020: 18% cash buyers (remember, interest rates were at an all-time low this year, so with it being cheap to borrow money, more people went that route)

- 2021: 26% cash buyers (this was one of the most competitive markets we’ve ever seen in Austin, and more buyers brought cash to seal the deal)

- 2022: 25% cash buyers

- 2023: 25% cash buyers

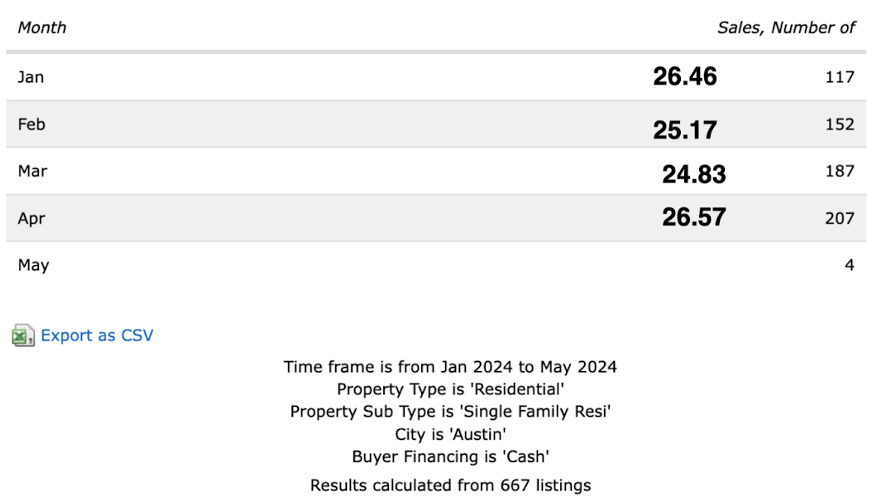

If we average the last six years, around 22% of homes were purchased without a loan. The numbers are holding steady in 2024 with around 25% of buyers making cash offers. For comparison, the National Association of Realtors reported that on the national level 32% of homes were purchased with cash.

Since almost a quarter of Austin home purchases are made using cash, I expected to see more cash-only transactions getting a better deal on the purchase price of their home. But as we can see above, that’s not how it plays out.

There’s one notable caveat: we don’t have access to data on private market sales. In my experience cash offers are more frequent in the higher price brackets that are often sold off market. Given that, it may be that cash is still king in off-market home sales.

SO WHERE DOES THAT LEAVE TODAY'S HOMEBUYER?

Several factors can make a cash offer more beneficial to the homeseller and get you a better price on your home purchase. But at its most basic, the magic of a cash offer is two-fold: it gives you the advantage of a faster closing time, and it provides more certainty that the deal will work out since you don't have to rely on the approval of a third-party lender. So, if the homeseller needs money as soon as possible, a cash buyer can leverage that to their advantage.

That said, don’t feel like you have to save enough money to make an all-cash offer to win the home of your dreams. Most of Austin’s real estate transactions are financed. And remember this: a good real estate agent can write a compelling offer that can beat a cash offer in almost every way. The one exception is closing speed, and if that’s the seller’s priority, then the cash offer will almost always prevail.

It really comes down to the seller’s priorities. Indeed, from my small corner of the real estate world, when sellers have multiple offers, they often seek my guidance in identifying the offer that nets them more money. Greater certainty, like what you get with a cash offer, usually comes in second to pocketing more profit.

CASH OFFERS COME WITH THEIR OWN RISK.

Not only are most Austin real estate purchases financed, it’s important to remember that cash offers carry their own risk. Before making a cash offer, consider:

- Your cash will no longer be liquid. Once you put money into real estate, it gets harder to get it out quickly, which may result in you losing out on other opportunities.

- In the interest of a speedy closing, you might be tempted to skip parts of the transaction that are required with conventional financing, like appraisals and surveys. I’m not suggesting a cash buyer should do all the things a bank would have you do, but I do suggest that you take your time and not rush through your due diligence when making such a substantial purchase.

- Cash offers don’t leverage your money the same way financing does. In the real estate world you want to use other people’s money (aka the bank) to increase your return without putting as much of your own cash into the investment. With a cash offer, you are all in without any leverage.

- With a cash offer you lose out on available tax deductions for mortgage interest.

THERE'S A TIME AND PLACE FOR CASH OFFERS, BUT I WOULDN'T SAY CASH IS KING.

Frankly, I was surprised by these results. I expected cash offers would garner more benefits during a purchase negotiation. That may be the case nationally, but not here in Austin.

No doubt, a cash offer can make a difference in some cases like a competitive market or where the seller really needs a quick sale. If you have the desire and resources to make a cash offer, go for it.

But, if you aren’t one of the lucky few that can afford to make a cash offer, don’t give up. Most Austin real estate transactions are financed, and you don’t have to make a cash offer to win a negotiation. The purchase method is just one of the many contingencies that can be used to make your offer compelling.

Undecided about your next home purchase? Funding your home purchase is one of the many things we can talk you through. Let us know how we can help you move forward.

May 2024

.jpg?w=128&h=128)

You might also like

You might also like