Real Estate Reflections: Austin homes undervalued by 17% as of February 2023

With all the talk of the affordable housing crisis, would you believe that Austin homes are actually undervalued by 17% as of mid-February 2023?

Yep. I’d even go so far as to say that Austin has returned to being a good deal for folks looking to make a move.

Let’s break it down.

All the talk about housing affordability is legitimate, and I don’t mean to undermine the seriousness of that issue. The reality, however, is that 2022 and January of this year acted like a giant eraser and wiped out many of the housing gains we saw since the pandemic first hit Austin in March 2020. In fact, Austin’s home price appreciation has tumbled to 2020 levels.

Say what?

When we back up and look at a historical median price chart of single family homes for the Austin metro area, Austin home prices are now below where they would have been if COVID and all the pandemic stimuli had never happened.

Assuming that Austin homes (excluding townhomes and the like) would continue to appreciate at the same average trending rate we saw between 2014 and 2020, it’s fair to say that single family homes in Austin would have appreciated 8.5% on average in 2021 and another 8.5% in 2022. So if we had stayed on our average appreciation trajectory given our recent pre-pandemic history, home prices would be up about 17% in 2023. But then COVID hit and things went wonky.

What actually happened was that home prices sky-rocketed in both 2020 and 2021, far outpacing the normal growth pattern. It was crazy, and it was unsustainable. Then along came 2022. While the year started strong, things like wars, economic uncertainty, and interest rate hikes slowly chipped away at the gains of the prior two years. When 2022 ended, it had erased about half the appreciation from 2020 and 2021. To top it off, home prices nose-dived between December 2022 and January 2023, actually putting us below pre-pandemic appreciation levels.

To put real numbers to it:

- Austin metro median home prices were $327,963 at the end of 2020,

- median prices jumped to $420,000 by the end of 2021,

- median price dipped to $360,000 at the end of 2022, and

- as of mid-February median prices in the Austin metro have dropped to $304,000.

The chart below demonstrates the swing; there’s a wild uptick in 2020, and our current line is at or a little below those levels today. Remember that our data has a 30 day lag because of closing timelines, so it will be interesting to see the February stats so we can determine whether the December to January drop was just a holiday slow down or something more enduring.

Funny thing, isn’t it? If we had grown like normal we would actually be ahead of where we are today…. That means Austin is undervalued by about 17% as the market sits right now. I don’t, however, think we will stay down for long though.

In our December 2022 blog post, we indicated that we were seeing signs that the real estate market had hit bottom. At that time we couldn’t be sure if it would endure or was just a head fake. Well, here we are mid-February and so far – despite the December to January decline -- indications are that we are on the rebound. The February numbers will tell us more. Here are the four reasons I feel confident saying the market is rebounding after having hit bottom.

1. DOWNWARD NEGOTIATIONS ARE ON THE DECLINE

In a seller’s market like the one we experienced in 2021, it was almost unheard of to negotiate the purchase price downward on a home. Things have definitely shifted since then. Most negotiations these days are downward. But…. The price decrease is less than it was a couple of months ago.

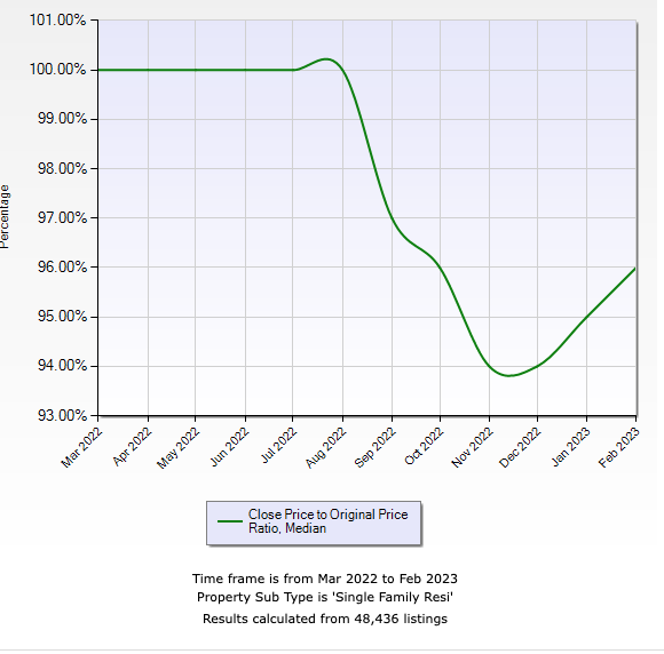

Right now we see sellers reduce their asking price 1-3 times. The stats show us that sellers are also smartly reducing their price publicly on the Multiple Listing Service (MLS) rather than take a lowball offer. Below is a chart that we use to get a sense of the over and under-numbers compared to list price. In November 2022 sellers were getting about 93% of what they asked for, and this month they are getting around 96%. It’s slow improvement, but it’s improvement all the same.

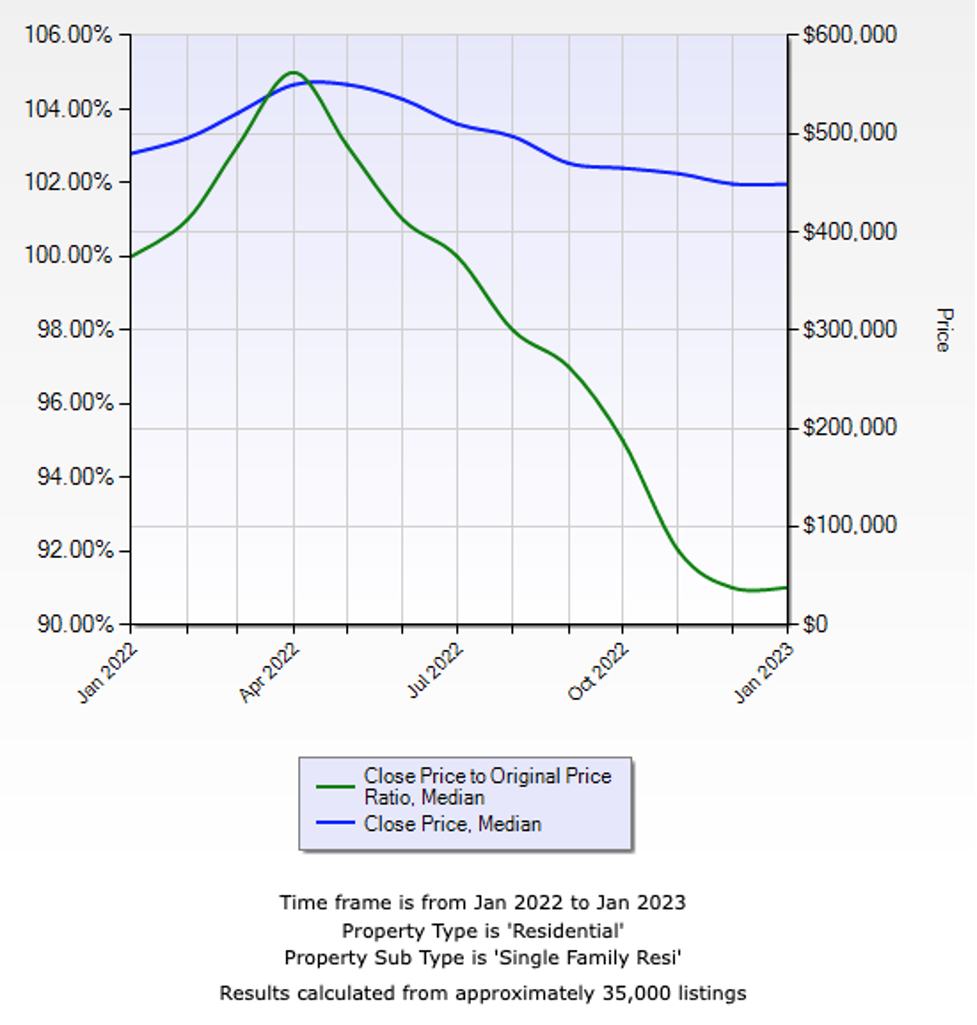

Here’s how things shook out for the Austin metro area in 2022 to the present. The blue lines represent the median price and the green ones represent how much over or under the original list price the home sold for. Many homes have been through multiple price reductions. As we look at the data, sellers are not going to be far below the list price without making a public price reduction. In this case you can see from the blue line that we started 2022 with the median sales price going 5% over the list price, then we bottomed at 91% of the list price in January. This signals to me that there is a comeback afoot.

Here’s how things shook out for the Austin metro area in 2022 to the present. The blue lines represent the median price and the green ones represent how much over or under the original list price the home sold for. Many homes have been through multiple price reductions. As we look at the data, sellers are not going to be far below the list price without making a public price reduction. In this case you can see from the blue line that we started 2022 with the median sales price going 5% over the list price, then we bottomed at 91% of the list price in January. This signals to me that there is a comeback afoot.

We also see a wide variance in different parts of Austin right now, so this month we also ran some specific numbers for some of the common neighborhoods in Austin. If you’d like to see a similar chart for your particular MLS area, just reach out. We’ve got them ready to send!

We also see a wide variance in different parts of Austin right now, so this month we also ran some specific numbers for some of the common neighborhoods in Austin. If you’d like to see a similar chart for your particular MLS area, just reach out. We’ve got them ready to send!

2. HIGHER INTEREST RATES CREATED PENT-UP DEMAND FOR AUSTIN HOMES

Interest rates had a real impact on how far your money could go when buying a house. Buyers lost about 40% of their buying power in 2022. It sounds a little crazy, but with so many people side-lined by high interest rates last year, we are facing some pent up buyer demand.

Looking for proof? Check out the volume of multiple offers we are seeing. Over the last 90 days, around 9.5% of our Austin homes went under contract in 5 days, which is the likely timing for multiple offers to occur. For context, back in the insanely competitive days of 2021, homes would go under contract within 5 days around 40 – 50% of the time. Thankfully, we aren’t there, but we are seeing the percentage of multiple offers creep back up, which tells me buyers are ready to engage when they find a home that checks all the boxes.

Mortgage applications also continue to rise, and this is one of the main ways we measure buyer demand. But more mortgage applications don’t necessarily mean more home sales. Right now Austin home sales are lagging behind the rise in mortgage applications.

Why the lag? For starters it could be an issue with low inventory and there not being many good houses on the market right now. With 80% of homeowners at a 4% mortgage rate or less, there’s also not a lot of incentive for sellers to put their home on the market, which exacerbates the inventory problem. That said, active listings are up from 1,762 in January 2022 to 6,350 in January 2023. Even so, that’s still below the inventory levels we saw in the pre-pandemic (March 2020) days.

It can also be that buyers are taking more time to make a purchase. Personally, we’ve had more buyers reach out to us, but no one is in a rush to make a purchase. Some of them are investors that want to dip their toe back in the market and slowly ramp up. Others are buyers that want to get a feel for the market so they are ready to act quickly when the right house comes on the market (this is a good approach, by the way). And, we also have several groups of buyers that paused their home search due to layoff concerns. I don’t blame them for that. Being prudent is a good thing.

3. THE AUSTIN ECONOMY HAS A POSITIVE OUTLOOK

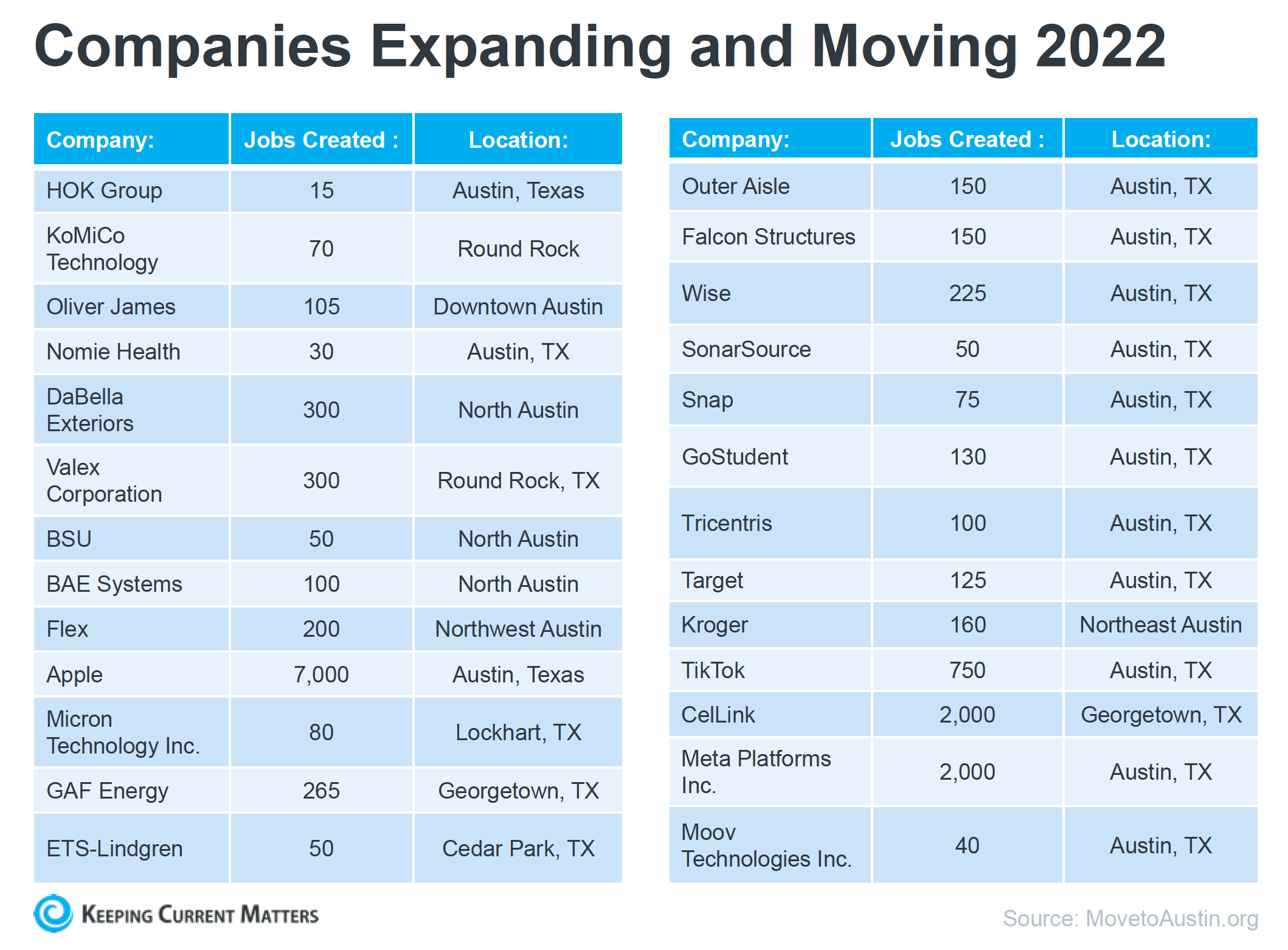

When looking at the future of the Austin real estate market, I always pay attention to our unemployment numbers, corporate relocations, and employment growth. As of December 2022, Austin’s unemployment rate was 2.7%, which is good. Plus, we have a strong pipeline of corporate relocations to Austin. Just check out this graph I borrowed from David Childers of Keeping Current Matters. It’s crazy.

Also, economic experts like Mark Sprague are expecting between 2- 4% employment growth for the Austin area this year. A lack of qualified applicants and the burden of interest rates are the biggest hurdles to job growth. Overall, however, the economic forecast for Austin seems positive.

Where does the current state of the Austin real estate market leave you?

We have different advice and strategies depending on whether you are buying or selling. Below is our advice for buyers and sellers, but please reach out if you have specific questions about your situation.

IF YOU ARE THINKING OF BUYING: If you’ve been wanting to buy a home, this is as good of a time as we’ve seen in awhile. Rates won’t be this high forever, and you will likely be able to finance in a few years. We suggest getting out there before the competition peaks. And if it helps, these are the three most common questions we are getting from our buyers right now.

- How much is the off-peak sales price of this house? Inside the Austin metro area, single family home prices peaked in June with a median price of $550,000. In January, the median price was $449,293. We are down or off peak 18.31%.

- What should we offer? This depends on what sub-market you are looking at and how long the house has been on the market. The longer it’s been on, the more aggressive we can be. If you are buying the median house, and it’s been on the market for over 30 days you might consider asking for 7% or so off the list price and hope for the best. You can see in the over/under chart where the trend is headed. Remember that all the sold data here is about 30 days old from when the buyer made their offer.

- Should we invest in buy-downs to lower our interest rate? If you can stand the payments, I wouldn’t invest my money in a buy down because the odds are good you are going to refinance once rates go lower. I can get in trouble if I talk too much out of my lane, so talk to your finance professional for specific financing advice.

IF YOU ARE THINKING OF SELLING: If you are thinking about selling, remember this isn't the fairy tale market that it was a year ago. Here’s what you need to know:

- Price matters more than ever; don’t measure your home against the comparable sales but against what else is on the market that buyers can choose from.

- In most cases, it takes a couple of months to sell. Be patient.

- The odds are good you may face multiple price adjustments.

- Pre-inspections are more critical than ever so that the offers you get are more likely to stick.

- If you have a choice about when you will sell, we recommend March/ April for the spring market or over the summer if rates start coming down.

- The job of a listing agent just got a lot harder. This is what we call a "skills market." Work with someone that has been through a downturn before.

THERE IS ALWAYS A PATH FORWARD

Depending on how the Federal Reserve tweaks interest rates this year, we think it’s entirely likely we may see some starts and stops in the market with periods of high activity followed by slower times. If you want to talk through your options or timing, we are here to help. There is always a path forward, and we are good at coming up with a solid plan to get you were you want to be.

February 17, 2023

FIND AN AUSTIN HOME YOU LOVE

We educate you on Austin neighborhoods, help you avoid costly mistakes, and guide you through the process of finding that special home where your best memories will be made.

SELL YOUR AUSTIN HOME WITH EASE

We help you keep all the balls in the air, reduce the stress of the process, all while attracting potential buyers to your house so you can sell quickly for the best price.

.jpg?w=128&h=128)

.png)

.jpg)