Real Estate Reflections: Is Austin in a housing bubble?

Last week the U.S. Federal Reserve indicated there may be a housing bubble brewing. Gulp. Certainly, the Federal Reserve is a highly credible source worth considering. Yet, I had to question whether we are approaching a housing bubble or experiencing a housing shortage?

THE FEDERAL RESERVE'S POSITION

So why is the Fed concerned about a brewing housing bubble? First, they analyzed market "exuberance." This is when home prices increase at a rate that can't be justified by economic fundamentals. A 95% threshold typically signals that the market is experiencing abnormally explosive behavior. Our current exuberance level? A whopping 115%.

Next, the Fed measured home prices against the sum of discounted future rents. It's one indicator of value, and it too is showing exuberance at levels comparable to the last housing boom.

Last, the Fed examined the ratio of home prices to disposable income as an indicator of housing affordability. This has not quite risen to the level of exuberance. But yes, prices are rising. Want proof? The median listing price for a home within the city of Austin (not metro) was $565,000 as of mid-February 2022. For comparison it was $455,000 at the same point in 2019.

Let’s remember though that the increase in housing costs didn’t come out of nowhere. The price of homes has been on a steady incline since about 2012, and then there was a slingshot effect in 2020. Thankfully, “rapid real house-price appreciation, such as that observed now, does not in itself signal a bubble,” according to the Fed.

If you’d like to get the information straight from the source, you can check out the Federal Reserve’s full statement.

PUTTING THE STATISTICS IN CONTEXT

All this reminds me of former Fed chair Alan Greenspan’s remarks about “irrational exuberance” as it related to the burgeoning dotcom bubble back in 1996. Are we there now? Maybe, but I don’t think so.

While you can’t argue with the Fed’s statistics, I think it is important to put them in context and understand what else is going on in the market that is driving these numbers. Indeed, the Fed acknowledged that the underlying cause of the current housing run-up differs from the last housing boom and bubble.

Home buying lurched during the pandemic due to a confluence of issues – increased demand, easier access to money, shrinking resale inventory, and a shortage of new builds to name a few. For starters, millennials – which now represent the largest U.S. generation -- have moved into their prime home buying years. That translates into a large number of new homebuyers actively looking for homes. With millennials entering the market, 12.3 million new households have been formed since 2012, yet only 7 million new homes were built during that same time, according to USA Today.

Buyer demand was also boosted by fiscal policy. Historically low interest rates during the pandemic gave buyers more leverage than in normal times. Pandemic-related fiscal stimulus programs also put some transitory funds into the economy. Greater disposable income and easy access to credit gave buyers the ammunition to fuel their fear of missing out. Austin in particular suddenly had a large contingent of out-of-state buyers with money to spare. Buyers were ready to buy and many would do whatever it took to win.

Not only is the increase in homebuyers putting pressure on the market, the pandemic changed how we use our homes. During the height of the pandemic millions of people began to work from home, prompting some to move out of cities or look for bigger dwellings to cope with the reality of remote work. Many employees were no longer tethered to a particular city, so some expanded their search out-of-state putting added housing pressure on desirable locations like Austin.

The pandemic also changed people’s plans and caused resale inventory to shrink even further. The majority of current homeowners in the U.S. are baby boomers or older who were less inclined to put their home on the market and welcome strangers into their homes in the middle of a pandemic. Other people that had plans to sell decided to stay put given uncertainty driven by the pandemic. And let’s not forget that there was also a portion of potential home sellers that stayed put because their home loan went into forbearance during the pandemic. Even people that wanted to sell found they’d have nowhere they could afford to move to, so they too didn’t put their home up for sale. It all adds up to dwindling resale inventory.

To make matters worse, new construction wasn’t (and isn’t) keeping up with demand. Like most industries, residential construction experienced significant supply disruptions during the pandemic. I know of one builder that would get new windows delivered from their vendor in small batches, but not enough to complete one whole house; so each week the builder had to figure out which house would get the windows and move one slow step closer to completion. The cost of construction materials also skyrocketed, as did labor costs. Worker shortages only aggravated the situation.

No doubt, there’s exuberance in the housing market. But is it irrational? There is some irrationality to be sure, but the context tells me that the bulk of the housing pain we are feeling now is based on legitimate and logical issues. Before I explain my disagreement with the Fed, let’s take a trip down memory lane to the housing bubble of the mid-2000s.

WHAT'S A HOUSING BUBBLE?

At its most basic, a housing bubble occurs when demand for housing outpaces the supply of available homes. This is not to be confused with the normal ebb and flow of supply and demand. In a housing bubble there is a period of unexpected or unusual growth that throws off economic balance. With the supply and demand curve out of whack, buyers have limited options, so fear of missing out pushes them to pay top dollar to make a purchase, and that can cause home prices to rise at an alarming rate. The bubble pops, so to speak, when supply eventually realigns with demand and home sales and prices drop. In that case recent home purchases may not align with current/lower values, and sellers may end up with properties that sit on the market or sell for far less than anticipated.

Housing bubbles aren’t a new concept. I’ve personally lived and worked through several housing bubbles (and a dotcom bubble too). However, one of the most well-known housing bubbles burst in 2008. In that case expansion of money supply, low interest rates, and looser lending practices led to an unusual demand for homes and rampant speculative investing. Ultimately too many home buyers got a mortgage loan that was simply too expensive for them to afford, and the rest is history as they say.

But I don’t think we are in a housing bubble.

AUSTIN IS EXPERIENCING A HOUSING SHORTAGE, NOT A HOUSING BUBBLE

Let me begin by saying that I think the Fed is 100% right on all the factors they are relying on to caution about a potential housing bubble. I also think it’s smart to flash a warning signal to folks about what we may be facing. But I do think the Fed is not giving enough consideration to what is really causing the supply and demand curve to be so out of alignment: we don’t have enough homes for sale.

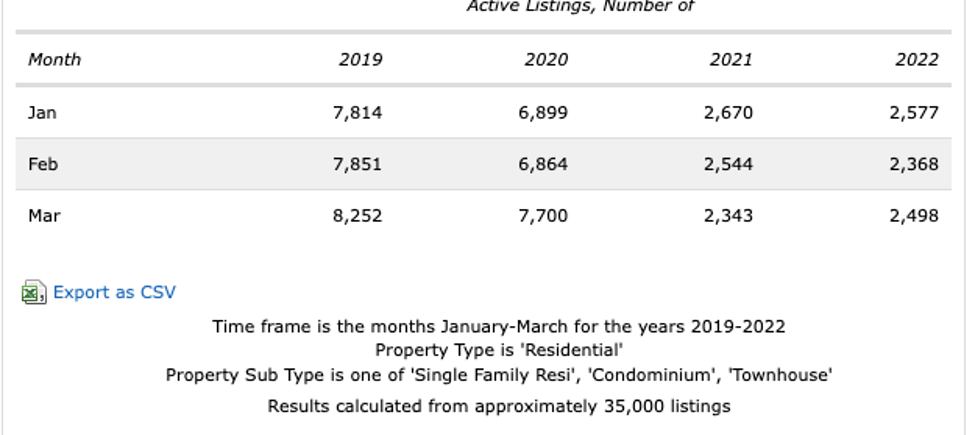

In a balanced real estate market we should have about six months of housing inventory or around 3,500 – 4,000 homes for sale. But check these stats. As of February 2022, there were only 371 homes for sale in the city of Austin (not metro). That’s astonishingly low.

Since 2019 the number of homes available for sale in the Austin area is down 69%. Just look at the chart for some sobering numbers. This same story is playing out across the country. We are running out of homes.

To get back to Austin’s 2019 version of a ‘hot’ market we need to have 2,000 – 3,000 homes on the market, along with fewer folks competing for homes. And if we wanted to shift to a buyer’s market? Well, in that case we would need 4,000 – 5,000 homes on the market, over 10x what we have now. We’re a far way off from being balanced.

To get back to Austin’s 2019 version of a ‘hot’ market we need to have 2,000 – 3,000 homes on the market, along with fewer folks competing for homes. And if we wanted to shift to a buyer’s market? Well, in that case we would need 4,000 – 5,000 homes on the market, over 10x what we have now. We’re a far way off from being balanced.

The last housing bubble had a chilling effect on new construction, and we haven’t caught up. Frankly, I’m not sure we can catch up. Economist Lawrence Yun of the National Association of Realtors says we need 6 to 8 million more homes to meet current demand. That means home builders would need to build 60% more homes over a decade. I just don’t see it happening.

Recall, a housing bubble bursts when supply finally catches up with demand. I don’t see supply catching up with demand any time soon. Even if demand cools significantly, we will still be short on homes. A more balanced housing inventory is at least 10 years away. And for that reason alone, I don’t think it’s fair to say this is a housing bubble. I think it’s a housing shortage.

WHAT HAPPENS IF WE ARE IN A HOUSING BUBBLE?

Let’s assume for a minute that the Fed’s prediction is right and we are approaching a housing bubble. It’s unlikely to be the crisis that it was in 2008. The Fed was clear: “based on current evidence there is no expectation that fallout from a housing correction would be comparable to the 2007–09 Global Financial Crisis in terms of magnitude or macroeconomic gravity.” That’s a relief!

What’s different this time? For starters, household finances are in better shape. People have more savings. Plus, banks aren’t lending silly money. Unsound lending practices are not creating mortgage credits or driving the current boom like they did back in in the mid-2000s. Also, while rising prices have made home ownership unattainable for many, it also means homeowners’ equity has grown substantially in recent years. Forty-two percent of homes are owned outright with no mortgage, and 58% of homeowners have at least 60% equity in their homes. That reduces the likelihood that those homeowners will be upside down on their loan if home prices were to dip. And like I mentioned, we are unlikely to see an overabundance of houses listed for sale that would saturate the market.

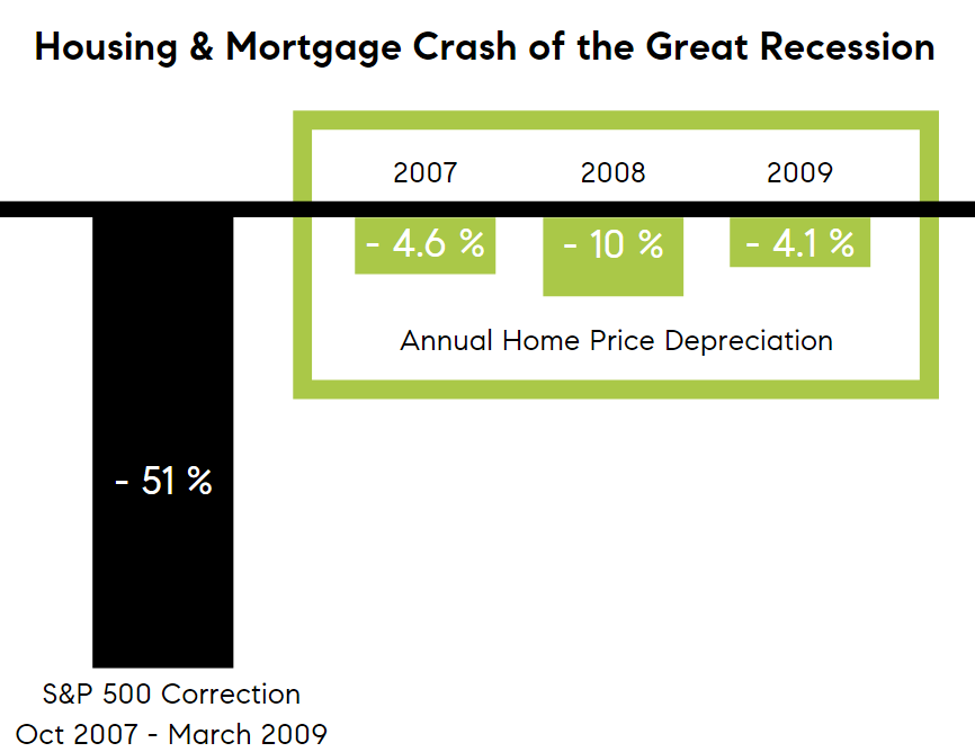

Even if we were in a housing bubble that burst, home prices in Austin are unlikely to nose dive. Using history as a guide, during the 2008 Great Recession Austin home prices declined around 3% while home prices elsewhere prices dropped between 4 – 10%. The chart below puts it in perspective.

In the last 40 years Austin home prices have only come down two times:

• Once in the 1980s during the savings and loan crisis, home prices dropped around 3%, and

• During the great recession of 2008 - 2011, Austin home prices declined about 3%.

In both cases the price reductions were short lived. Austin has experienced such high appreciation in recent years, that even with a 2-3% price decrease, most long-term homeowners would still be okay.

Plus, the Austin economy is arguably the strongest it’s ever been, and there’s no sign of that shifting. Indeed, Austin was just ranked #2 best performing city in the U.S. for 2022 by the Milken Institute. The city’s job growth, low unemployment rates, and our ‘cool’ factor should provide some shelter to Austin homeowners if a housing bubble bursts.

WHERE DOES THAT LEAVE THE AUSTIN REAL ESTATE MARKET?

Everyone, myself included, is speculating about the future. Regardless of whether it’s a bubble or not, here are some things to consider.

1. Buying a home in Austin is going to remain difficult for the next decade. We may see some relief here and there, but we are years away from a balanced market.

2. Interest rates will keep going up in the near future to combat inflation. As of April 6 rates are at 5.02% for a fixed 30-year loan — the highest since 2018. This will impact the market in a real way:

- For folks that need to borrow money to buy a home, the monthly cost of home ownership will exponentially increase as rates rise making it more difficult to purchase a home. Perhaps this will slow demand?

- Rising interest rates will further depress housing inventory. Sellers that are looking to buy a new home will also have to pay higher interest rates on their new purchase. It’s hard to trade in a low interest rate on an existing home for a higher interest rate on a new home if you don’t have to move. I expect many sellers will decide to hold onto their properties and rent them out to earn some cash and wait for rates to fall.

3. Homes will continue to get multiple offers, and we will continue to experience appreciation in home values. However, I predict that buyers will start paying a little less over the asking price, likely 10-20% over ask instead of 30% over ask like last year. I’d wager that the over ask number may even continue to decrease as fewer buyers will be able to compete when faced with higher interest rates.

4. Regrettably, the gap between folks who own a home and those who don’t is going to get wider.

My crystal ball is in the shop, but here’s my advice if you are considering jumping into the market.

For our Austin buyers: Buying a home in Austin is getting harder. As prices and interest rates rise, affordability becomes an increasing concern. If you are hoping Austin home prices will go down because interest rates are going up, I think you will be disappointed. History tells us we won’t see a major decline even if there is a recession or a housing bubble. I don’t believe we will see any real relief in price until the number of homes is high enough to satisfy or at least take the edge off of demand. If you can, act now before you’re completely priced out.

The good news is we have been helping our buyers win bidding wars for years now, and we know what it takes to win. We don’t like it or take any joy in asking you to do the things that are needed, but we can and we will give you a clear path to getting an offer accepted.

For our Austin sellers: I believe it’s still a good time to sell but pricing and preparation are key to maximizing your profit. First, we want to price your home to attract buyers. We carefully monitor the market in real time and will recommend a strong pricing position so that you hit the sweet spot of being high enough to meet your goals but not so high as to repel potential buyers. Second, you’ll probably hear that you don’t have to do anything to prepare your home. Don’t buy it. If you are a seller, now more than ever we really need to maximize your sale. That means making your home attractive enough so that it stops the constant scrolling online. And we’ve got a few strategies that can help you be in a powerful negotiation position during your option period (those are back, by the way). If you are concerned about spending money up front, we have a great Compass Concierge program that covers make-ready costs like staging, painting, and so on and lets you pay back the expense at closing without interest.

THE BOTTOM LINE: EVERYONE NEEDS TO LIVE SOMEWHERE.

Of course there’s exuberance in our market. Everyone needs to live somewhere.

As there are fewer and fewer homes available to buy, the demand for those homes will go up, and the prices will go up in turn. That’s a housing shortage, y’all. Actually, it’s a housing crisis. Until we solve that, don’t expect any major changes.

This isn’t my happiest blog post, but then again real estate isn’t always sunshine and roses. I don’t think the sky is falling, but whether you are buying or selling it’s important to know where things stand and where they may be headed. Whatever your goals may be, it definitely helps to have a seasoned expert who has successfully navigated fluctuations in the market for the past three decades. That’s me!

Thanks for reading this far! I’d love to know your thoughts. Please drop me a line if you have any questions, want to learn more about the market, or if you’d like to explore joining our team.

Your real estate novelist,

Paul

Wherever life takes you, we can help you get there.

See our real world results

Can you imagine loving your real estate experience? It’s possible! Just look at our reviews on Yelp and Zillow.

Take the next step

Are you ready to find a home you love? We're here to guide you through the process. Contact us to schedule a consult.

Stay on top of the Austin real estate market.

Sign up for our email updates.

We respect your inbox. We only send interesting and relevant emails.

.jpg?w=128&h=128)

.png)

.jpg)