Real estate reflections: half-time is over in the Austin real estate market

Cue the Rocky music. Gonna fly now…

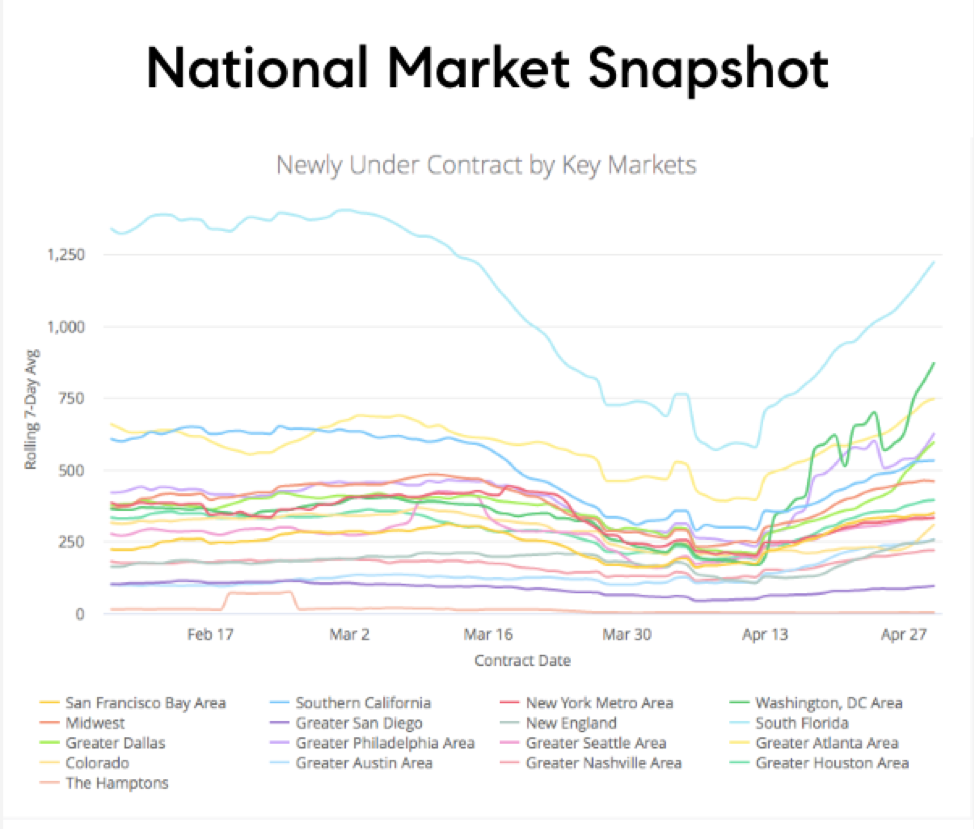

You know we aren’t prone to hyperbole when it comes to the state of the Austin real estate market, but we are excited to share some positive news this week. The United States real estate market is making a comeback, Austin included. Let’s start with a national market snapshot.

The national real estate market is re-bounding

A quick look at all the homes under contract in the major metropolitan areas that Compass serves shows that we hit bottom in early April and across the nation we are on an upward climb. Austin is the blue line in the middle.

Hindsight on the Austin real estate market is 20/20

Hindsight on the Austin real estate market is 20/20

To give you some perspective, let’s look at how far we’ve come. The Austin Board of Realtors hasn’t released their April 2020 market stats yet, but the preliminary numbers from Independence Title are instructive. For the Austin metro area we saw single family home sales drop 23.8% in April. Likewise, the number of properties that went under contract decreased by 25.7%. There were also 21.3% fewer new listings put on the market this April compared to April 2019.

This matches the decline I predicted after the Austin Board of Realtor’s March stats initially seemed so artificially rosy. The market paused and transactions slowed, as expected. There were fewer buyers looking for homes and fewer sellers putting their home on the market which meant there were fewer sales overall. Interestingly, Austin’s housing supply (sellers) and demand (buyers) both decreased at a comparable rate in April, so while the number of transactions decreased the make-up of our market held steady.

While the number of real estate transactions were down in April, those transactions that did close showed good results. The median sales price went up by 4.4% year over year in April. Similarly, the median days on market went down by 31.3%. That means homes sold faster and for more money in April 2020 than they did in April 2019.

The drop in the real estate market was relatively short lived as activity started to pick up again during the latter part of April. Even as recently as last week the Austin Board of Realtors reported 290 new listings, 339 pending listings, 138 sold listings for the City of Austin (not metro) from May 4 – May 10th. We are quickly approaching last year’s 2019 activity levels.

So yes, the market slowed. And no, it’s not back up to pre-COVID19 levels we would normally see at this time of year. But, it is on the rise. Prices are up year over year. There is still demand from buyers, and there are fewer homes on the market keeping our supply and demand in parity.

Where do we go from here?

We are regularly talking with folks that want to know where the market is headed. Everyone, myself included, is speculating about the future. The speculation generally breaks down into three different types of behavior:

- The market is recovering, and I want to act now;

- The unemployment rate is going to drag us straight into a ditch for years to come so I’m going to sit tight; or

- Let’s watch how this evolves before making a move.

While I can’t predict the future, let’s look at what we do know.

What do we know?

National unemployment rates are high at 14.7%. While this isn’t a surprise, it is scary from a future economy perspective. Recovery is sure to slow when almost 15% of our population is not spending money. Thankfully, when surveyed 5% of the 15% reported that they believe their situation is temporary. If that turns out to be the case, we still need to find a solution to get the other 10% back to work ASAP.

Market demand is strong. We know market demand is strong across the country. If anything, the coronavirus has increased the appreciation of home as we’ve all sheltered in place. Here at Homesville we’ve personally had buyers feeling more comfortable heading out to look at homes, sellers are making moves to put their properties on the market, and the listings we did put up for sale all sold the first weekend on the market. In many areas of Austin, we have less than one month's supply of homes. It's still a hot market; it just got smaller with fewer buyers and fewer sellers engaged.

Buyer preferences are shifting. The National Association of Realtors (NAR) tracked the behavior changes of homebuyers and sellers in its 2020 NAR Flash Survey: Economic Pulse. The results showed some interesting shifts in buyer preferences. For example, 5% of the respondents said buyers are shifting their focus from urban to suburban areas. This matches what we are hearing as we strategize with our colleagues across the nation – many people want to escape high density cities. Some of those people will move to Austin. Interestingly, Idaho, Utah, and Arizona are turning out to be top destinations… If you’ve got the urge to move, this cool calculator will help you figure out what you can save in taxes by relocating.

The type of home searches are also shifting (perhaps temporarily?) as 1 in 8 Realtors reported changes in desired home features like home offices and bigger yards. Searches for new homes were up 40% since sheltering in place began, searches for homes with pools tripled, searches for outdoor space doubled, and the minimum square footage in home searches increased by 6%. We recently held a panel discussion with Joel Aldridge of Aldridge Architecture, David Birt of Furman + Keil Architects, and Brent Spraggins of Brent Design to discuss what changes we may see in home design as a result of the coronavirus. It was a great discussion full of thoughtful ideas.

Home equity is high. Unlike the Great Recession of 2008, this time around people have equity in their homes. Forty-two percent of homes are owned outright with no mortgage, and 58% of homeowners have at least 60% equity in their homes. Likewise, prices have not gone down. Instead they are going up, at least for now.

This tells me that mass foreclosures are not on the horizon, although I do worry about the folks that have elected to go into forbearance. (Please don’t go the route of forbearance if you can avoid it. Let’s talk first.) That’s not to say we won’t see some foreclosures. Those investors behind home leans are going to need their money at some point. Here in Austin, however, I would expect that most homeowners will be able to sell their way out and keep most of their equity. Time will tell.

Where does that leave you?

If you are a buyer that either needs a home or wants to move up, this is a decent time to make a move. Rates are low, and I believe that there is little chance prices are going down. On the downside the market remains tight. We still have a housing shortage in Austin, business are still moving to the area (hello Tesla!), and nothing meaningful has changed in the supply-demand curve. In fact, we may see demand go up as people consider moving to Austin as they flee their apartments and condos in higher density cities.

If you are a seller, now is a great time to put your home on the market. Housing inventory is really low, meaning there aren’t as many homes on the market and you’ll have less competition. Plus, the buyers that are out there tend to be serious about purchasing a home, and they are frustrated by the lack of choices.

The challenge is selling safely. It’s a little harder if you’re living in your home, but it’s pretty straight forward if your property is vacant. Either way we have strategies to keep you safe and get your home sold.

If you are an investor, we are always keeping an eye out for opportunities for you. The market is changing week by week, so let’s stay in contact.

Please stay safe, and thank you for reading. I’d love to get a quick note back letting me know how you are doing. If you or any of your friends want to chat or Zoom about any of this stuff, we are here for you.

May 17, 2020

.jpg?w=128&h=128)